Cryptoasset markets or Blockchain-enabled Decentralization

FINANCIAL REGULATIONS AND PRICE INCONSISTENCIES ACROSS BITCOIN MARKETS (2017)

Published: Information Economics and Policy, June 2017

- (Free) Working Paper: SSRN or Globalization Institute Working Paper 2016-292

- [Data], [Slides]

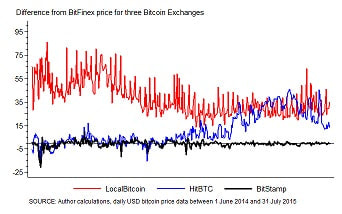

Abstract: We document systematic differences in bitcoin prices across 11 different markets representing 26% of global bitcoin trade volume. These differences must --- due to the identical nature of all bitcoin--- result from characteristics of markets themselves. We examine differences across the markets and find that those which do not require customer identification for establishing an account are more likely to deviate from representative market prices than those which do. This implies that standard financial regulations, specifically know-your-customer regulations, can have a non-negligible impact on the bitcoin market.

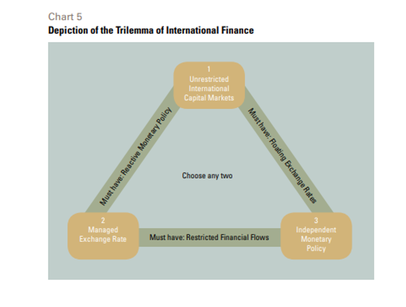

THE POTENTIAL IMPACT OF DECENTRALIZED VIRTUAL CURRENCY ON MONETARY POLICY (2017)

Federal Reserve Bank of Dallas Globalization and Monetary Policy Institute 2016 Annual Research Report

Abstract: The border-free nature of decentralized, virtual currencies --- Bitcoin is only one example --- presents an interesting challenge for monetary policy which assumes some amount of government control over cross-border financial flows and exchange rates. At the extreme, decentralized virtual currencies systems may force all countries to accept floating exchange rates and unrestricted financial flows.

Abstract: The border-free nature of decentralized, virtual currencies --- Bitcoin is only one example --- presents an interesting challenge for monetary policy which assumes some amount of government control over cross-border financial flows and exchange rates. At the extreme, decentralized virtual currencies systems may force all countries to accept floating exchange rates and unrestricted financial flows.

BITCOIN REVEALS EXCHANGE RATE MANIPULATION AND DETECTS CAPITAL CONTROLS (2017)

Abstract: Many countries manipulate the value of their currency or use some form of capital control, yet the data usually used to detect these manipulations are low frequency, expensive, lagged, and potentially mis-measured. I demonstrate that the price data of the internationally traded cryptocurrency Bitcoin can approximate unofficial exchange rates which, in turn, can be used to detect both the existence and the magnitude of the distortion caused by capital controls and exchange rate manipulations. However, I document that bitcoin exchange rates contain problematic bitcoin-market-specific elements and must be adjusted before being used for this purpose. As bitcoin exchange rates exist at a daily frequency, they reveal transitory interventions that would otherwise go undetected. This result also serves as verification that Bitcoin is used to circumvent capital controls and manipulated exchange rates.

- Non-Technical Media Summary;

- Technical/Academic Working Paper:

- Online Appendix

BLOCKCHAIN TECHNOLOGY DISRUPTING TRADITIONAL RECORDS SYSTEMS (2017)

This was originally published in the now defunct "Financial Insights" newsletter from the Dallas Fed. A version of the paper is kept on SSRN.

Abstract: The article gives a very general introduction to the technology, promises and limitations of blockchain technology --- popularized by the digital currency Bitcoin and a key force behind the surge of cryptocurrencies. Blockchain acts as a distributed database or joint global register of all transactions --- a decentralized digital ledger --- and has the potential to become a disruptive force in the financial industry and elsewhere, bypassing traditional, centralized channels such as banks.

Abstract: The article gives a very general introduction to the technology, promises and limitations of blockchain technology --- popularized by the digital currency Bitcoin and a key force behind the surge of cryptocurrencies. Blockchain acts as a distributed database or joint global register of all transactions --- a decentralized digital ledger --- and has the potential to become a disruptive force in the financial industry and elsewhere, bypassing traditional, centralized channels such as banks.

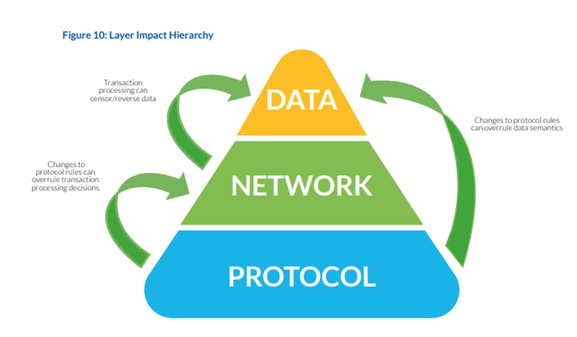

DISTRIBUTED LEDGER TECHNOLOGY SYSTEMS: A CONCEPTUAL FRAMEWORK (2018)

This report is an interdisciplinary, academic-industry partnership to create a unified language and analytic framework that both researchers, developers, and policy-makers can use to allow analyze, model, discuss, and regulate DLT's (and blockchains).

2ND GLOBAL CRYPTOASSET BENCHMARKING STUDY (2019)

This report is constructed from surveys incorporating answers from approximately 75% of firms in the cryptoasset industry, covering exchanges, miners, wallets, and hardware producers.

2nd Edition: January 2019 published by the Cambridge Centre for Alternative Finance.

2nd Edition: January 2019 published by the Cambridge Centre for Alternative Finance.

3RD GLOBAL CRYPTOASSET BENCHMARKING STUDY (2020)

This report is constructed from surveys incorporating answers from approximately 75% of firms in the cryptoasset industry, covering exchanges, miners, wallets, and hardware producers.

- 3rd Edition: September 2020 published by the Cambridge Centre for Alternative Finance.

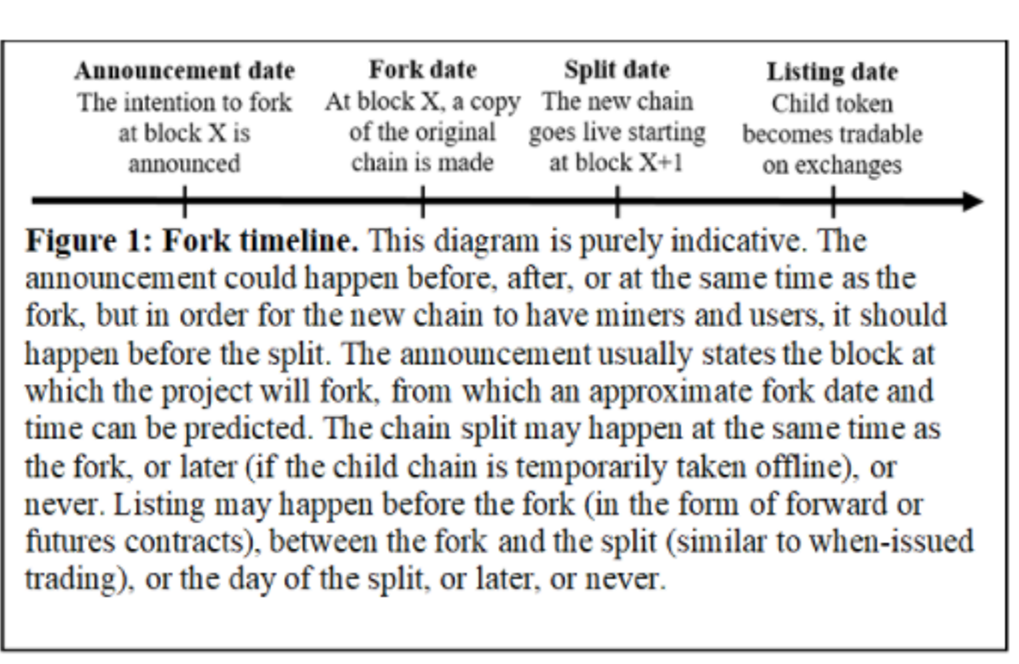

TAXING BLOCKCHAIN FORKS (2020)

|

Abstract: The tax treatment of cryptocurrency forks presents four unique challenges: (1) parent/child designation, (2) taxpayer access to the new token, (3) assessment of fair market value, and (4) assessment of comparable contemporaneous fair market values. We provide empirical evidence that each of these issues is a hurdle in determining whether income has been realized, or in apportioning the basis. We consider three existing approaches for assets acquired without a purchase. We conclude that the least problematic approach (adopted by Japan) is giving zero tax basis to the new coin and taxing the proceeds upon a sale, while treating the new coin as realized income (as recently ruled in the US) is the most problematic.

|

THE EVOLUTION OF CRYPTO-BASED GOVERNANCE (2022)

Co-authored with Kevin Werbach, Primavera De Filippi, and Josh Tan

Economics Pedagogy or Teaching

SEEKING TEACHERS: JOB CHANGES IN USA ACADEMIC ECONOMICS DEPARTMENTS (2021)

Joint with Christopher J. Roark

Abstract: We document the evolution of the number of economists in tenure-track and non-tenure track part-time and full-time positions at USA academic economics departments from 2005 to 2018, and job postings for USA located, academic positions from 2014 to 2019. Non-tenure full-time academic positions are increasing both in number and share in the representative department, with full-time non-tenure track economists now comprising approximately 10% of academic economists. We also provide evidence of the importance of the 2008 recession in department composition, and evidence consistent with a broad decline in tenure-success.

Concurrently, we find that the number of academic job postings for tenured/tenure-track positions declining at an annualized rate of 3.6% even as new PhD’s increased by 1.9%, while postings for postdocs doubled, and postings for teaching-specialist economists remained constant. These results imply that the profession is undergoing fundamental shifts in its job market that has, to the best of our knowledge, not been formally documented and calls into question the wisdom of PhD programs that assume a default of a “tenure-track Assistant Professor” outcome for their students.

Concurrently, we find that the number of academic job postings for tenured/tenure-track positions declining at an annualized rate of 3.6% even as new PhD’s increased by 1.9%, while postings for postdocs doubled, and postings for teaching-specialist economists remained constant. These results imply that the profession is undergoing fundamental shifts in its job market that has, to the best of our knowledge, not been formally documented and calls into question the wisdom of PhD programs that assume a default of a “tenure-track Assistant Professor” outcome for their students.

A GUIDE TO THE U.S. ACADEMIC ECONOMICS JOB MARKET FOR TEACHING-FOCUSED JOBS (2022)

Co-authored with Melanie Fox, Ben Harrell, Nakul Kumar, Daniel Lee, and Allison Luedtke

Abstract: There are many great job market guides for economists seeking a job at a research-intensive institution, including an official guide from the American Economic Association. This guide is meant to complement those existing documents by focusing on a section of the academic Economics job market that is still a mystery to many graduate students (and their committee members!), despite being the fastest-growing part of the market (Pieters and Roark, 2021): academic teaching-focused jobs. This guide aims to fill the gaps in existing offerings by detailing the idiosyncratic nature of teaching jobs, how to prepare for them, where to find them, what committees look for in your application, as well as what applicants can expect from the process.

Abstract: There are many great job market guides for economists seeking a job at a research-intensive institution, including an official guide from the American Economic Association. This guide is meant to complement those existing documents by focusing on a section of the academic Economics job market that is still a mystery to many graduate students (and their committee members!), despite being the fastest-growing part of the market (Pieters and Roark, 2021): academic teaching-focused jobs. This guide aims to fill the gaps in existing offerings by detailing the idiosyncratic nature of teaching jobs, how to prepare for them, where to find them, what committees look for in your application, as well as what applicants can expect from the process.

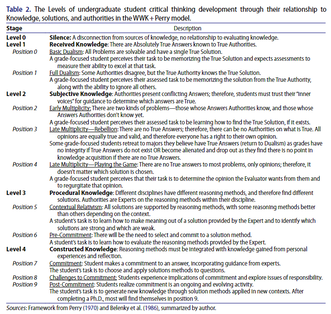

DESIGNING EFFECTIVE ASSESSMENTS IN ECONOMICS COURSES: GUIDING PRINCIPLES (2023)

The Journal of Economic Education or SSRN (pre-print version)

Abstract: Used correctly, assessments play a vital role in the success of a course: they provide valuable feedback to students regarding their knowledge gaps, encourage deeper understanding of the material, help students to develop critical thinking, and guide students to accomplish a course’s learning goals. They also provide a signal to future employers, graduate programs, or future course instructors about the quality of a student’s understanding of the material. Used incorrectly, assessments likely achieve none of these. To avoid the latter outcome, this article’s author helps new instructors by (1) summarizing pedagogical theory of sound assessment design, (2) applying it to assessment design in economics courses, and (3) assembling examples of assessments from the economics literature for instructors who may wish to experiment with different assignments.